Tax-smart investment1A comprehensive suite of strategies designed to help you reach your goals faster. |

Manage capital gains

The rate at which an investment is taxed when you sell it depends in part on the amount of time you've owned it. When selling investments in your account, we'll generally first look to sell those that you've held for longer than one year, allowing us to take advantage of lower long-term capital gains tax rates.

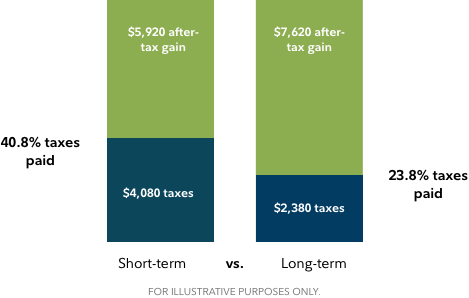

How deferring the realization of short-term gains in favor of long-term gains can lower your tax burden

How it works

In this hypothetical example, an investor holds a security with a pre-tax gain of $10,000. If the security were held for less than one year, it would be taxed at the investor's federal tax rate as ordinary income. Assuming the investor is in the top marginal tax bracket, that would result in $4,080 in taxes paid, for an after-tax profit of $5,920.

However, if that same security were held for more than one year, that $10,000 realized gain would be taxed at the investor's long-term capital gains rate of 23.8%, resulting in an after-tax profit of $7,620. As you can see, length of time you've held an investment when you sell it can make a big difference.

Bear in mind that this hypothetical illustration assumes the gains were taxed at the current maximum federal long-term capital gains rate of 23.8%. These calculations also include a 3.8% Medicare surtax.