Tax-smart investment1A comprehensive suite of strategies designed to help you reach your goals faster. |

Invest in municipal bond funds or ETFs

Depending on your tax bracket and financial situation, the investment team may look to municipal bond funds and ETFs when it comes to the bond portion of your asset allocation, drawing on the extensive analysis of our in-house research team.

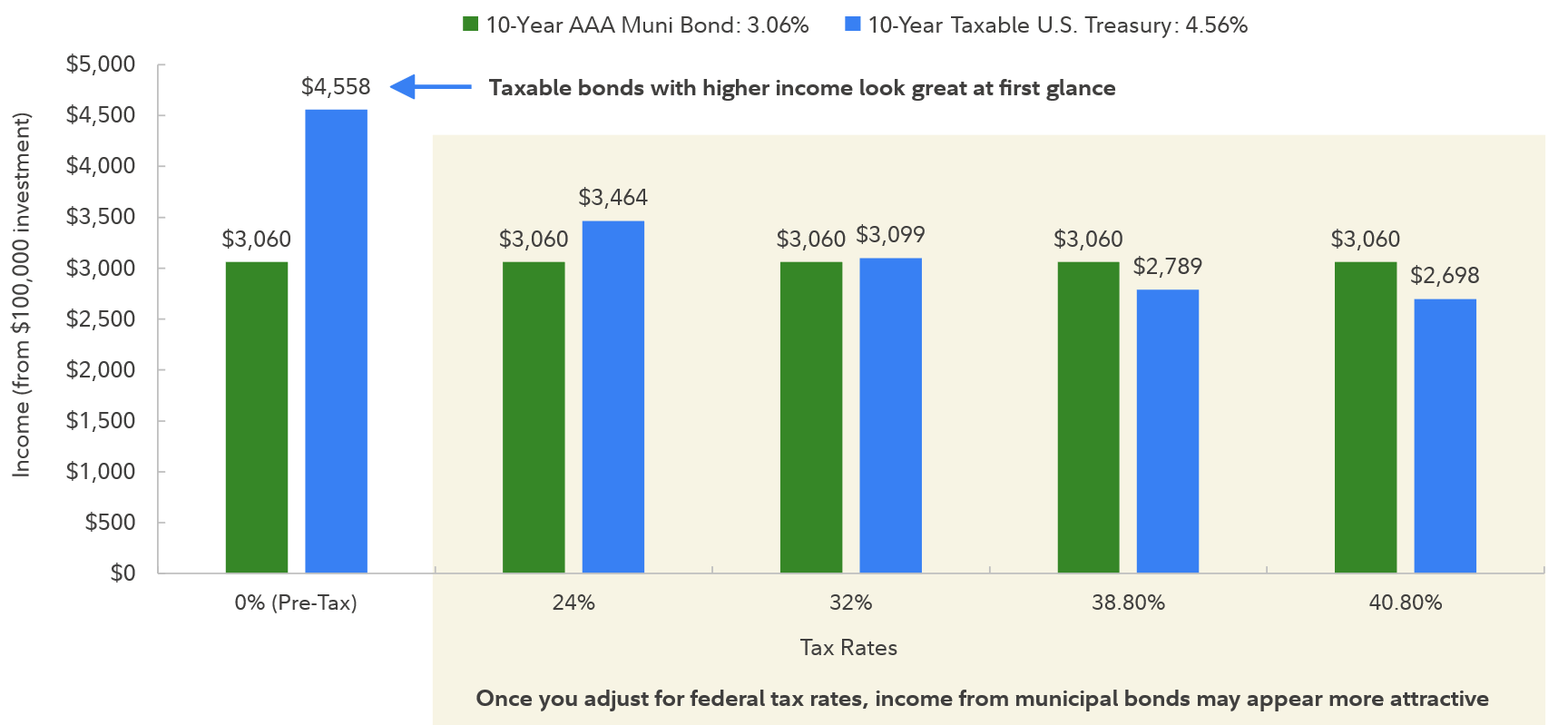

These investments may help you keep more of what you earn because the municipal bonds typically generate income free from federal taxes and, in some cases, state taxes.

While municipal bond yields are often lower than similarly rated taxable bonds, when you adjust for federal tax rates, their after-tax yields may actually be higher.

A closer look at after-tax yields shows that income from municipal bonds may be more attractive

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity to avoid losses caused by price volatility is not possible.

The municipal market can be affected by adverse tax, legislative or political changes and the financial condition of the issuers of municipal funds. Although municipal funds seek to provide interest dividends exempt from federal income taxes and some of these funds may seek to generate income that is also exempt from the federal alternative minimum tax, outcomes cannot be guaranteed, and the funds may generate some income subject to these taxes. Income from these funds is usually subject to state and local income taxes.