4 options for your old 401(k)

1. Roll over to Fidelity IRA

Roll over to Fidelity and consolidate your retirement accounts in one place while continuing tax-deferred growth potential1 through a wide range of investment options.

2. Roll over to a new workplace plan

If allowed, consolidate your 401(k)s into one account with your new employer, continuing tax-deferred growth potential. Investment options vary by plan.2

3. Stay in your old 401(k)

If your former employer allows, keep your money where it is. You'll continue your tax-deferred growth potential... but can't contribute anymore. Investment options vary by plan.

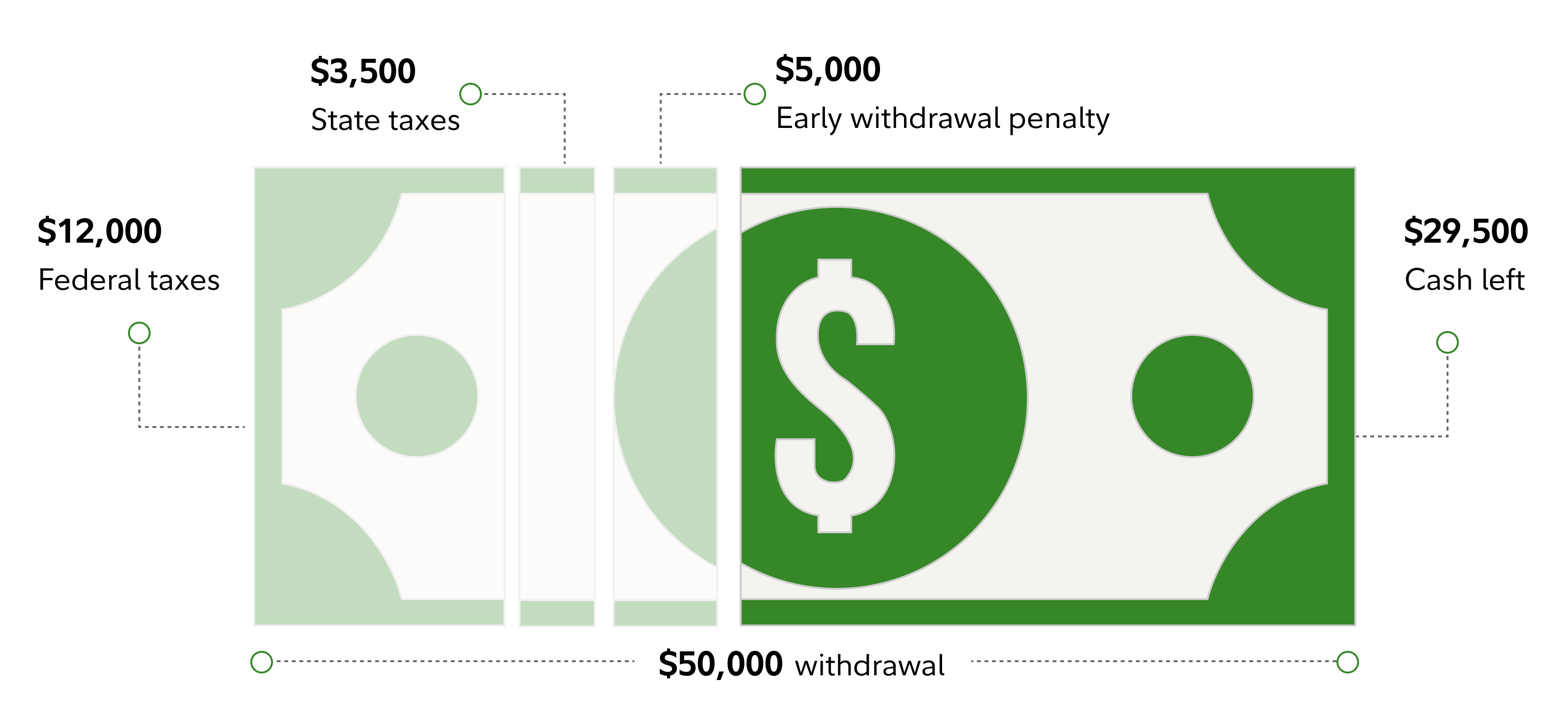

4. Cash out (and pay taxes)

Any cash you withdraw will be subject to state and federal taxes and, before age 59½, a 10% withdrawal penalty may apply.3 Also, your money won't have the potential to continue to grow tax-deferred.

Withdrawing $50,000 in cash before age 59½ could cost $20,500 in penalties and taxes

Resources

Rollover overview

Get more info about our Rollover IRA options as well as step-by-step instructions. Learn more

If you're self-employed

You may be able to roll over to your own small business retirement plan, such as a SEP IRA. Learn more