Guaranteed income with protection against market fluctuations Create future guaranteed income to cover essential expenses in retirement

The New York Life Clear Income Advantage Fixed Annuity—FP Series offers you (or you and your spouse) guaranteed income with protection from market fluctuations and built in flexibility.1, 2, 3

Predictable guaranteed income for the rest of your life, starting when you're ready.

Stability

Secure guaranteed income, no matter what happens in the market

Guaranteed income

Avoid outliving your assets with a steady cash flow for your lifetime1

Flexibility

Choose when you start your income and access2 your account value if plans change

How can Clear Income Advantage fit into an income plan?

Guaranteed lifetime income means just that. You will receive reliable income payments you can't outlive. Learn more in this video.

The longer you wait to take it, the higher your potential income may be.4

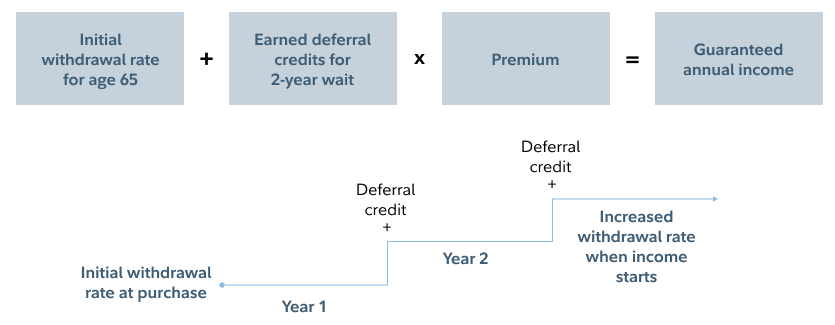

New York Life Clear Income Advantage is a fixed deferred annuity with a Guaranteed Lifetime Withdrawal Benefit (GLWB). The GLWB is determined by the amount of your initial investment, initial withdrawal rate, and potential deferral credits. Let's dive deeper below.

How is my income calculated?

Let's take Alice as an example

- Age 65

- Retiring at 67

- Withdrawal rate locked in at time of purchase

- Each full year she chooses to delay taking income, she earns what's called a Deferral Credit, a predetermined percentage that is added on to her initial withdrawal rate on each contract anniversary4

More details

Minimum investment

$50,000

Current rates

Your account value grows at 1% each year5

Product may not be available in all states

Ready to get started

- Schedule an appointment

- Tell us what you'd like from an annuity

- Work in close collaboration with us to help create a plan that meets your needs

Learn more about retirement income planning with annuities

Discover how a mix of investments can help provide income and growth potential in retirement.

3 keys to your retirement income plan

Build a plan with income, growth potential, and flexibility in mind.

Create future retirement income

Diversify how you create income in retirement to support your lifestyle.