EDUCATION & SUPPORT

It can be intimidating not knowing how to get started, which is why Fidelity provides a variety of free resources, digital tools, and educational content to break down the basics.

Fidelity Money Personality℠

Discover your unique money personality to help make the most of your financial decisions.

Spotlight: Financial Education in the Community

Fidelity partners with educators, schools, and nonprofits to provide them with the necessary tools to teach children about healthy money habits from an early age.

Five Money Musts

A fun, free digital tool to experience the basics of budgeting, credit cards, debt, investing, and retirement.

Fidelity Smart MoneySM

Find out what the news means for your money. Plus, get tips to help you spend, save, and invest better delivered to your inbox every week.

Building a Budget

Helps investors to see how their actual savings and spending compare with our guidelines.

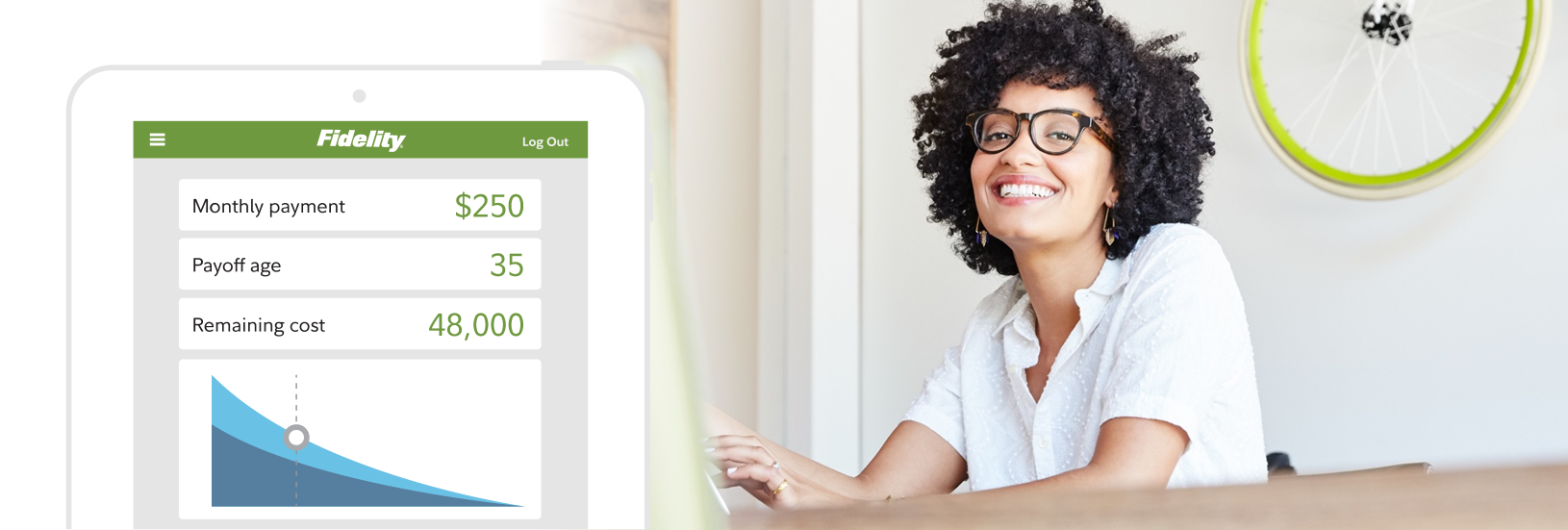

Navigating Student Debt

Provides a clear picture of how much is owed and how long it will take to pay off.

Evaluating a Job Offer

Takes the guesswork out of evaluating the true value of an offer.

Renting vs. Buying

Navigate the short- and long-term costs and feel prepared for this major financial decision.

Partnering and Getting Married

Comprehensive resources to help couples navigate important conversations about everything from moving in together, planning a wedding, and planning for a financial future.

PRODUCTS & SERVICES

We offer industry-leading value as well as digital experiences curated specifically for new investors to make it simple to check account balances, make transactions, and track toward specific goals.

Fidelity BloomSM

A free* financial app that helps you save more, spend less, and feel better about your finances.

The Value You Expect

Straightforward pricing + low-cost services = simple to get started.

Fidelity Go®

A simple and convenient robo-advisor platform that gives investors low-cost, low-stress access to Fidelity’s professional money management, with no account minimum.

Fidelity YouthTM

Teens ages 13–17 can learn to make, manage, and invest in the Fidelity Youth™ app—with a free debit card1 and no subscription fees, account fees, or minimums to open2.

Socially Responsible Investing

Fidelity offers solutions that align investors’ financial goals with personal values.

We get it, finances are personal.

When it’s easier to talk to someone live, we’re always just one call or chat away.

* The Fidelity Bloom app is free to download. Fees associated with your account positions or transacting in your account apply. Accounts made available via the app may be subject to fees.

1 The Fidelity® Debit Card is issued by PNC Bank, N.A, and the debit card program is administered by BNY Mellon Investment Servicing Trust Company. These entities are not affiliated with each other, and Fidelity is not affiliated with PNC Bank or BNY Mellon. Visa is a registered trademark of Visa International Service Association, and is used by PNC Bank pursuant to a license from Visa U.S.A. Inc.

2 Zero account minimums and zero account fees apply to retail brokerage accounts only. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs) and commissions, interest charges, or other expenses for transactions may still apply. See Fidelity.com/commissions for further details.

CITIZENSHIP & IMPACT

We support investors who want to engage in their communities and influence environmental, social, and governance (ESG) outcomes.

Expanding Access

Fidelity is committed to expanding access to financial literacy to individuals and communities who have historically lacked access.

Investing in the Next Generation: Fidelity Financial Forward℠

We created a resource that equips educators, parents, and volunteers with the tools and curriculum to encourage positive financial behavior formation in the youngest investors.

Beyond Financial Literacy

Fidelity also invests in the community through our environmental sustainability efforts, diversity and inclusion work, and more.

JOIN THE CONVERSATION

We’re meeting our customers where they are, in order to listen, educate, empower, and inspire.

An official Fidelity customer care channel where users can get answers about investing with Fidelity directly from associates.

YouTube

Educational videos for investors at every level re: planning, products, market trends, and more.

The latest news on Fidelity’s products, services, corporate citizenship initiatives, and advocacy efforts.

Newsletters

Fidelity offers a wide range of weekly and monthly newsletters to help you stay up-to-date with the latest insights on managing your life and money.