Fidelity Institutional Asset Management (FIAM) combines extensive research capabilities and a collaborative approach to offer advisors and institutions choice of products and solutions across asset classes to best fit their clients’ needs. Our portfolio construction offerings were built to help financial advisors stand out.

Click here to learn more about Fidelity’s asset management capabilities.

Who we serve

We help millions of individuals feel confident in their most important financial goals, manage employee benefit programs that help more than 28,200 businesses support their employees’ total well-being, and support more than 16,200 wealth management firms and institutions with innovative investment and technology solutions to grow their businesses.

We continue to challenge the status quo and harness innovation to move faster and create value for our customers and clients, developing new products and services to stay ahead of their distinct and evolving financial needs.

Our diverse businesses and independence give us insight into the entire market and the stability and scale needed to think and act for the long term as we deliver value to our customers and clients.

individual investors

We provide financial planning, advice, and educational resources to help investors—including young and first-time investors—make their goals a reality. Our straightforward pricing delivers value—with no account fees, no minimums to open a retail brokerage account, commission-free trades and more.

employers

We work closely with employers to create dynamic, integrated benefit programs for their employees, including retirement savings, health and welfare, stock plan services, emergency savings, charitable giving and student loan repayment programs.

advisors & institutions

We help wealth management firms and institutions navigate the changing industry landscape to grow their businesses and meet their clients’ financial needs. In addition to our insights, expertise and exceptional client experience, we provide investment and technology products and solutions, clearing and custody services, and institutional trading products, services and execution to thousands of firms.

charitable donors

Fidelity Charitable, an independent public charity with a donor-advised fund program, makes charitable giving accessible, simple and effective for more than 300,000 donors and counting.

innovators

We are constantly innovating to serve our customers’ evolving needs. Always challenging the status quo means exploring new technologies to enhance the customer experience and deliver even more value.

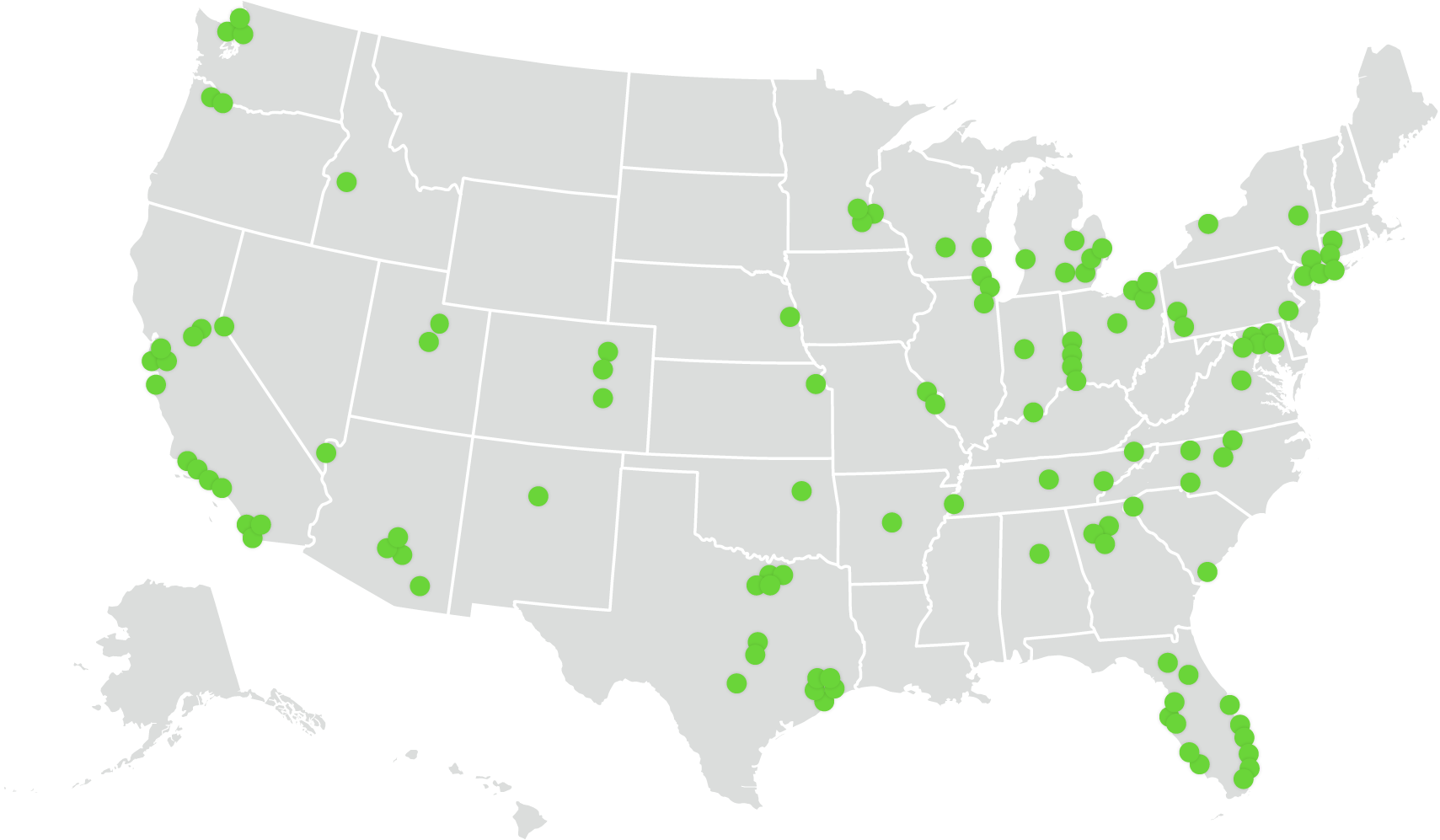

Our Presence

With more than 76,000 associates working tirelessly to meet the needs of our customers, Fidelity’s global presence spans 11 countries across North America, Europe, Asia and Australia.

Boston Headquarters

Regional Office

Investor Center

Headquartered in Boston, Fidelity serves its customers through 216 Investor Centers in the U.S. and 14 regional sites across the globe, including India and Ireland.

Find an investor

center

our history

"Take intelligent risks rather than follow the crowd." This was the inspiration with which Edward C. Johnson 2d founded the company, and it continues to guide us forward as a pioneer in the world of investing. As the financial industry evolves and customer needs become more complex, Fidelity has and continues to innovate, and transform itself to be ready for the financial landscape of tomorrow, while ensuring we are meeting the needs of our customers today.

Fidelity celebrates 75 years since its founding, and an unwavering focus on strengthening and securing our clients’ financial well-being.

Fidelity establishes a new company, Fidelity Digital Assets, providing products and services to institutions investing in bitcoin and other digital assets.

Fidelity launches the Fidelity ZERO Funds, the industry’s first zero expense ratio self-indexed mutual funds for individual investors.*

In a watershed moment for blockchain, Abby Johnson speaks about blockchain technology’s potential benefits at Consensus 2017, the largest blockchain conference in the U.S.

Fidelity Labs introduces the Student Debt Program, which includes a tool for exploring repayment options and a life-changing benefit to help employees pay off student loans faster.

Abigail P. "Abby" Johnson became chairman of FMR LLC, in addition to being named chief executive officer in 2014. She is the third generation to lead the privately-owned company.

Fidelity Go, developed in collaboration with young, digitally savvy investors, is an advisory solution designed for investors seeking a trusted team to manage their money through a simple and efficient digital experience.

Added Amazon's Echo to the Fidelity mobile lineup. Amazon Echo uses artificial intelligence and allows for hands-free, voice control to ask "Alexa" questions and ask Fidelity to get equity quotes and the market update.

Fidelity Charitable, called 'an early adopter' in the field of philanthropy and digital assets as it begins accepting bitcoin donations in response to donor preferences.

To gain experience in new voice—and gesture—based interfaces, Fidelity produces the first financial services application for Google Glass.

Fidelity’s Next Generation Contact Center is introduced. This cross-company program provides customers with a seamless and engaging experience regardless of how they choose to interact with Fidelity.

The Fidelity Patent Program is launched to protect Fidelity's inventors and best ideas through the application and creation of formal patents.

Fidelity receives ISO 27001 certification for data security, earning "world class" status for a zero-defect audit from the International Organization for Standards in Geneva, Switzerland.

Fidelity WealthCentral®, the industry's first web-based wealth management platform, combines portfolio management, customer relationship management (CRM), financial planning, portfolio rebalancing, and trading.

Fidelity Labs is founded to accelerate the development of new tools and capabilities for Fidelity.com. Today, Fidelity Labs continues to play a critical role in driving growth and innovation, providing a safe space for Fidelity to explore new business ideas and quickly test them with the diverse set of customers, businesses and financial institutions we serve.

The Fidelity Retirement Income Advantage is introduced as a comprehensive service that helps investors plan and manage their finances throughout retirement.

Fidelity Center for Applied Technology (FCAT) is established to research and explore emerging technologies and drive innovation across Fidelity. By 2018, FCAT’s focus includes experiments in the areas of virtual/augmented reality, artificial intelligence, digital currencies, and blockchains, looking for and creating new ways of using these technologies to improve people’s financial lives.

Fidelity becomes an Internet pioneer as the first mutual fund company to create a home page.

The Fidelity Benefits Center is launched to provide administrative services for a company's 401(k) plans, pension plans, and health and welfare programs.

A state-of-the-art print and mail facility opens in Covington, Kentucky. Fidelity becomes the first company in the industry to apply manufacturing technology to print mail operations.

The Fidelity Charitable Gift Fund is formed to provide customers with simple, tax-advantaged charitable giving opportunities.

Fidelity launches Portfolio Advisory Services (PAS), offering discretionary investment management, asset allocation, and portfolio rebalancing for investors.

Abigail P. (Abby) Johnson joins the company as an equity analyst.

The Energy Conservation Program is launched to reduce energy usage in all Fidelity offices.

Plymouth Funds, launched and sold exclusively through broker-dealers, is renamed Fidelity Advisor Funds in 1992.

Fidelity Select Portfolios are the first in the industry to offer hourly pricing, replacing end of the day pricing.

Fidelity offers computerized trading on floppy disk with Fidelity Investor's Express (FIX), which enables customers to buy and sell stocks.

Fidelity's first street-level Investor Center opens in Boston, offering customers access to personal service, free information, and investment guidance.

401(k) products and services are first offered to plans utilizing Fidelity's mutual fund product line.

National Financial Services Corporation is established to provide broker-dealers with leading-edge clearing and execution products.

Fidelity launches 403(b) plans offered to government, nonprofit organizations, and educational institutions.

Edward C. Johnson 3d becomes chairman and CEO of FMR Corp.

Fidelity offers its first individual retirement account (IRA) a year after passage of the Employee Retirement Income Security Act (ERISA), allowing people to save pre-tax dollars in IRAs.

Fidelity installs its first 800 number to answer calls from prospective investors.

Fidelity Daily Income Trust (FDIT) is launched as the first money market fund to offer a checkwriting feature.

Fidelity International Limited is founded in Bermuda to manage mutual funds available exclusively to overseas investors. A research office also opens in Japan.

Fidelity starts a venture capital business.

Edward C. Johnson 2d and Edward C. Johnson 3d establish the Fidelity Foundation, pledging the firm's commitment to communities served by Fidelity.

Fidelity purchases its first computer, beginning the development of the latest technology to serve its customers.

Trend and Capital funds are introduced, two of the industry’s first aggressively managed equity funds.

Edward C. (Ned) Johnson 3d joins the company as a research analyst.

Fidelity Puritan Fund is introduced, the first Fidelity mutual fund with a goal of deriving income from stocks.

Fidelity Management & Research Company is founded to act as investment adviser to Fidelity Fund with Edward C. Johnson 2d as president.

Edward C. Johnson 2d is elected president and director of Fidelity Fund.

by the numbers

When our customers do well, we do well. As a privately held company, we use our investor mindset to make sound judgments for the long term on behalf of our customers and our business.

$15.0 trillion

assets under administration**

$5.8 trillion

total discretionary assets***

As of September 30, 2024

Q3 2024 BUSINESS UPDATES

Learn how Fidelity is helping customers and business clients achieve their financial, investment and employee benefit goals.

Asset Management

Find financial information about Asset Management, including its equity, fixed income, high income and alternatives and global asset allocation divisions.

*Fidelity now offers the Fidelity ZERO Total Market Index Fund (FZROX), Fidelity ZERO International Index Fund (FZILX), Fidelity ZERO Large Cap Index Fund (FNILX), and Fidelity ZERO Extended Market Index Fund (FZIPX) available to individual retail investors who purchase their shares through a Fidelity brokerage account.

**Fidelity Internal Information as of September 30, 2024.

***Includes all Fidelity investment products, such as mutual funds and managed accounts.