What are your investment choices?

The CHET 529 plan offers a range of investment options. Let us help you choose an option that makes sense for your situation.

Different investors have their own goals, risk-tolerance levels, and time horizons. A Fidelity managed 529 plan gives you multiple types of investment options to choose from. As a Connecticut resident, be sure to consider the state tax advantages and additional program benefits of a CHET 529 plan.

The following questions will help you decide the option that works best for you:

How do you want your 529 investments managed?

When was the child born?

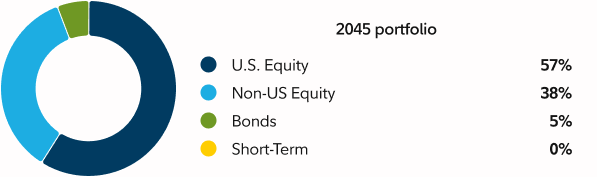

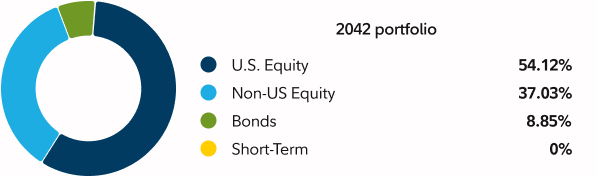

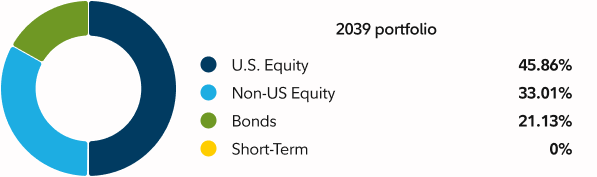

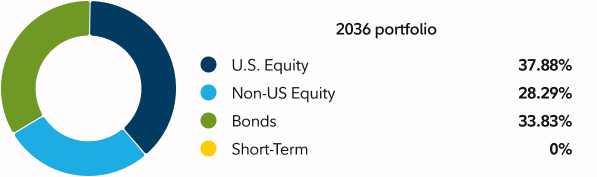

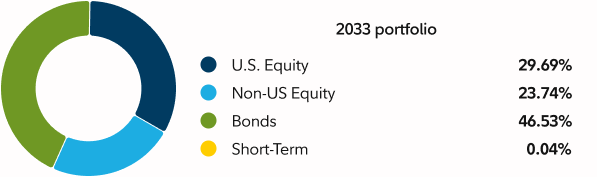

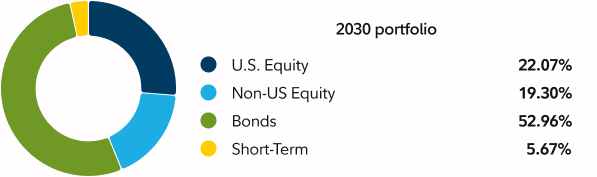

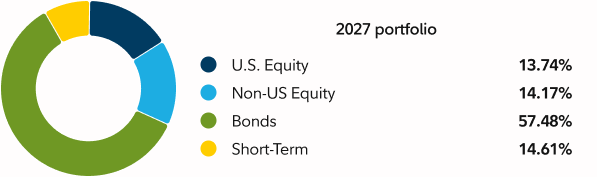

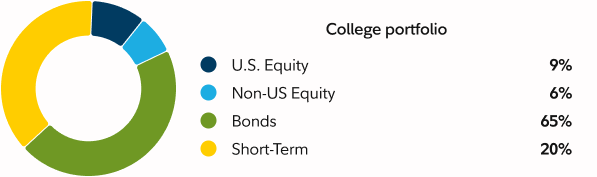

Age-Based Portfolios are mapped to a beneficiary's year of birth and the approximate year the beneficiary is anticipated to start college. Each portfolio is managed with the asset allocation automatically becoming more conservative as the beneficiary nears college age. Select your beneficiary's birth year below to learn more about your Age-Based portfolio investment options.

Select from 3 portfolio types

A custom strategy allows you to build your own investment mix from the 3 portfolio types shown below. You may allocate money to any number of funds you'd like, in 5% increments that total 100%.

To view current portfolio performance, asset allocation, expense ratios, and other fund research, expand a portfolio type below, then select a portfolio name from the list.

View information on the funds' short-term performance, or average annual total returns by month or by quarter.

Please review the 529 plan Fact Kit for more detailed information.

Learn more

Access a library of courses, articles, and videos to learn more about planning and saving for college.

Get started with college savings

Understand what it's like to have an account, from choosing a plan to withdrawing funds.

Anyone can use our college savings calculator to figure out how much to save each month. Login or become a member to create a personalized savings plan and track your progress.